Is Wealthsimple Worth It in 2025? My Honest Review

If you live in Canada, you’ve probably seen Wealthsimple everywhere. It’s on billboards, in YouTube ads, and it comes up every time someone talks about opening a TFSA. But does the app actually deliver, or is it just hype?

I signed up, put money in, and tested the different features. What follows is the real experience: the parts that worked, the parts that didn’t, and whether Wealthsimple is worth your time in 2025. Small note: I used my referral bonus to try it, so if you’re planning to sign up, here’s my link so we both get $25: [referral link].

What Wealthsimple Actually Is

Wealthsimple is a Canadian investing and banking app that tries to be a one-stop shop. You can open tax-friendly accounts like a TFSA, RRSP, or FHSA. You can trade stocks and ETFs without paying commission. There’s a crypto feature built right in. They’ve also added tax filing and a chequing account that comes with a Visa debit card.

It’s designed to feel approachable, and for the most part it does.

Wealthsimple Accounts Explained

Wealthsimple supports all the Canadian staples: TFSA, RRSP, FHSA, RESP for education savings, and retirement drawdown accounts like RRIFs. If you want something simpler, there are non-registered personal accounts. There’s even margin if you want to borrow against your portfolio.

Beyond investing, the chequing account pays interest and works for daily spending. Wealthsimple Tax, which used to be SimpleTax, is also included. And yes, crypto is supported if you want to buy and stake digital assets.

Wealthsimple Fees Explained

Here’s the breakdown you need to know:

Robo portfolios charge 0.5 percent for Core users, 0.4 percent once you pass $100k, and as low as 0.2 percent at the top tier. Stock and ETF trades are free in Canada, but U.S. trades quietly include a currency conversion unless you’re Premium or higher. Crypto trades cost between 0.5 and 2 percent depending on your plan. Margin interest starts at prime plus half a percent for Core, drops to flat prime for Premium, and goes to prime minus half a percent for Generation.

It’s all spelled out, but the FX fee on U.S. trades is an easy one to miss.

The Wealthsimple Tier System

Everyone starts at Core. Hit six figures across your accounts and you move into Premium, which gives you lower robo fees, advisor access, U.S. dollar accounts, and better trading rates. At half a million, you unlock Generation, which comes with custom portfolios, private credit, and the lowest fees they offer.

The upgrade is automatic once your balance qualifies.

Wealthsimple Portfolios

Wealthsimple’s robo-advised side is built around portfolios that combine a risk level with an investment style. When you sign up, the app asks about your goals, time horizon, and tolerance for risk. Based on that, it places you into one of three broad risk categories:

Conservative – more bonds, less equity, lower volatility.

Balanced – a middle ground between stocks and bonds.

Growth or Aggressive – equity heavy, higher potential returns, higher risk.

On top of the risk level, you choose a portfolio style:

Classic – a global mix of stocks and bonds.

Socially Responsible (SRI) – screens for companies with stronger ESG practices.

Halal – Shariah-compliant, avoids interest and restricted industries.

Every portfolio is automatically rebalanced, dividends are reinvested, and Premium or Generation clients also get tax-loss harvesting. This setup makes it possible to align both your risk tolerance and your values.

My Experience Using It

Here’s a look at part of my TFSA inside Wealthsimple. You can see I’ve mixed QQQ, SMH, and SPUS the app makes managing a variety of holdings straightforward.

Signing up was quick. Identity verification was smooth, deposits cleared without delays, and the app itself feels polished. The dashboard shows your portfolio value front and center, though if you’re used to advanced features it will feel barebones.

Buying my first Canadian ETF was seamless. No fees, no friction. Then I bought a U.S. stock and only later noticed the conversion fee. That stung a little. It made me realize Premium is almost a requirement if you plan to trade U.S. assets.

On the robo side, setting up a TFSA was painless. Automatic deposits, risk profile selection, and Wealthsimple did the rest: rebalancing, dividend reinvesting, and keeping the portfolio aligned.

To give you an idea of the variety, I’ve used Wealthsimple to pick up broad ETFs like QQQ and SMH, alongside individual stocks like ASML. The app handled all of it without issue. It showed me that you’re not limited to the big Canadian banks or a handful of local funds—you really can build a portfolio that mixes global tech leaders with diversified ETFs in one place.

Is Wealthsimple Safe?

Yes.

Investment accounts are protected by CIPF up to a million. Cash accounts are insured by CDIC through partner banks, also up to a million combined. Crypto is custodied by regulated third parties, though not CIPF-insured. Security features include two-factor authentication, biometric login, and full encryption.

The bigger risk is user-side: weak passwords or phishing attempts, not the platform itself.

What Works Well

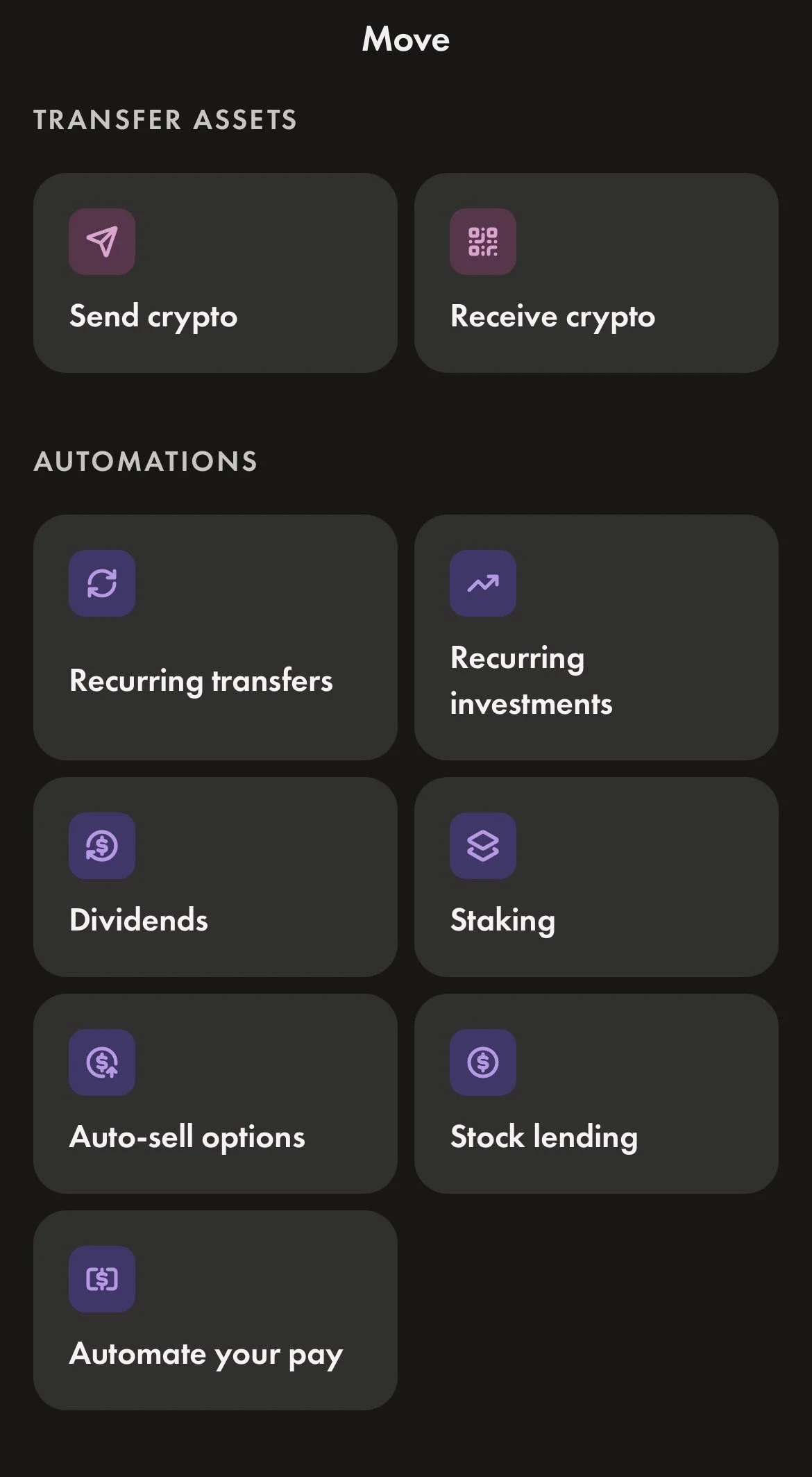

The dashboard keeps everything in one place from recurring investments to dividend reinvestment and even staking. It’s clean and easy to navigate. The whole app was well designed and easy to use.

Wealthsimple shines in its simplicity. No account minimums, free Canadian stock and ETF trades, and a design that doesn’t overwhelm beginners. The robo portfolios make investing boring, which is a compliment. If you want to automate everything and stop thinking about it, Wealthsimple makes that easy. If you’re more interested in spending tools than investing, I reviewed KOHO here.

Integration with Canadian account types like FHSA and RRSP also makes it practical. It’s rare to get this much functionality inside one app.

Where It Falls Short

The robo portfolios haven’t outperformed alternatives, and you pay more for them than if you just bought ETFs directly. Advanced traders will feel boxed in: no options, no detailed charting, no research tools. FX fees on U.S. trades also catch people by surprise unless they’re Premium.

And while the crypto integration is convenient, it can feel like Wealthsimple is chasing trends instead of focusing on its core mission. If you need help managing bills and subscriptions, check out my Rocket Money review.

The Referral Bonus

Wealthsimple’s referral program is straightforward. Sign up with a referral and once you open and fund your account, you and your friend both get $25. Bonuses usually show up in your chequing account within a day. There’s no limit on referrals.

Here’s my link if you’re signing up: [referral link]. Just remember you’ve got 30 days to fund the account or you won’t qualify.

Wealthsimple vs Competitors

If you want the cheapest way to build a DIY ETF portfolio, Questrade is still better. If you’re an advanced trader and want global access or options, Interactive Brokers wins. Wealthsimple sits in the middle: the easiest starting point for beginners and casual investors who want Canadian integration without complexity.

Final Verdict: Is Wealthsimple Worth It in 2025?

For beginners and casual investors, yes. The clean interface, commission free trading, and automation make it a great choice. For advanced traders who want complexity and the lowest costs, you’ll eventually want to move on.

Wealthsimple won’t give you the thrill of day trading, and that’s the point. It makes investing boring, and boring is usually the smartest way to grow your money.

If you want to try it yourself, here’s my referral link so we both get $25: [referral link].

Wealthsimple covers investing, but on ToolCradle I’ve also looked at tools in completely different spaces like Base44, which focuses on AI app development. The idea is the same: find tools that save you time or open up new opportunities.

Cradle Score: 4.4/5

Wealthsimple nails the basics. The design is clean, the automation is reliable, and Canadian specific accounts make it easy to get started. It loses points for FX fees, robo costs, and the lack of advanced features. Still, for most beginners, it’s one of the best ways to start investing in 2025.