Kikoff Review 2025: $5 Credit Builder Results, Costs, and Catches

This Kikoff review covers exactly how the $5/month credit builder works, real results from users, and how it compares to Self, Chime, and secured cards. If you’ve seen Kikoff’s offer, you’ve probably wondered if it’s a low cost credit hack or another fintech gimmick.

Quick Verdict

Kikoff is one of the cheapest ways to add a revolving tradeline without a hard credit check. It’s best for beginners with scores under 680 who want an easy first step toward building history. But it’s not magic, and the secured card isn’t truly free.

Cradle Score: 4.2 / 5

Why This Matters: A 30-Second Credit Score Primer

Credit scores are built on five main factors: payment history, credit utilization, length of credit history, credit mix, and recent inquiries.

A Kikoff tradeline targets two:

Payment history: On-time payments add positive history.

Credit utilization: The $750 limit can help if other cards are near maxed.

It won’t fix recent late payments or remove collections, but it can move the needle for those with little or no history.

What is Kikoff and How It Works

Basic plan: $5/month, $750 limit usable only in Kikoff’s store.

No hard pull: Signing up won’t hurt your score.

Flat cost: No interest or late fees.

Tradeline age: Account stays open after payoff, boosting average account age.

Real Results

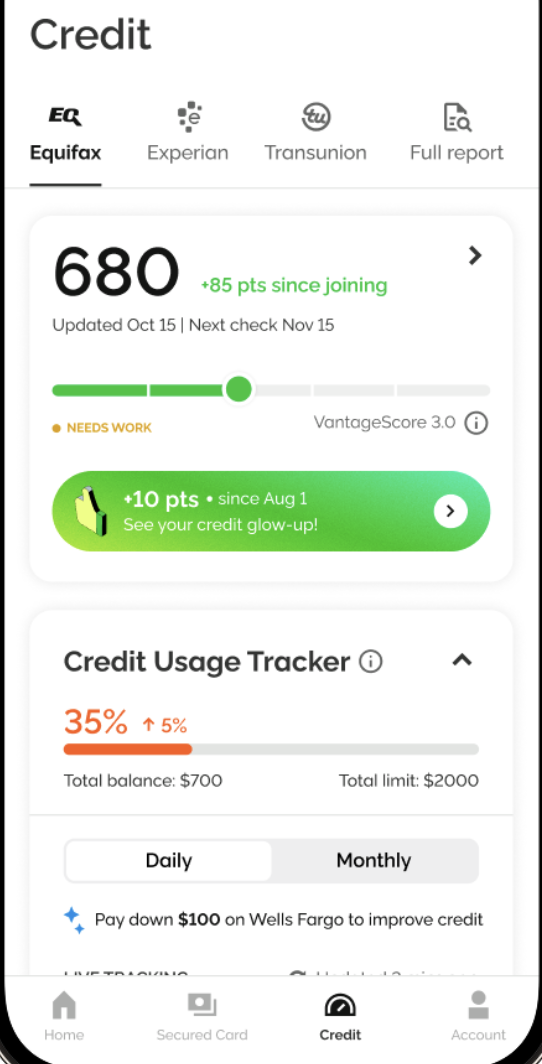

Example Kikoff dashboard with score progress and usage breakdown.

User reports show a range of outcomes:

Under-600 scores: Some saw +25 to +84 points over 6–12 months.

Thin files: Early bureau reporting within 30–45 days, first score appearing around the same time.

Mixed reviews: A few users saw no change after 2 months, usually because they already had multiple tradelines or high utilization elsewhere.

Honestly, I wasn’t expecting much from a $5 plan, but digging through Reddit showed a few people with 40+ point jumps in just a couple of months.

One Reddit user shared: “Using Kikoff’s $5 plan, my score went up 42 points in two months , nothing else I tried worked that quickly.” Another reported: “I paid for six months and only saw 10 points. It helped, but not as much as I hoped.”

Kikoff itself claims an average +28 point gain in the first month for under-600 profiles, though that’s internal data.Want to see if Kikoff (check it out) works for you? You can check eligibility in minutes with no impact to your credit score.

Feature Breakdown

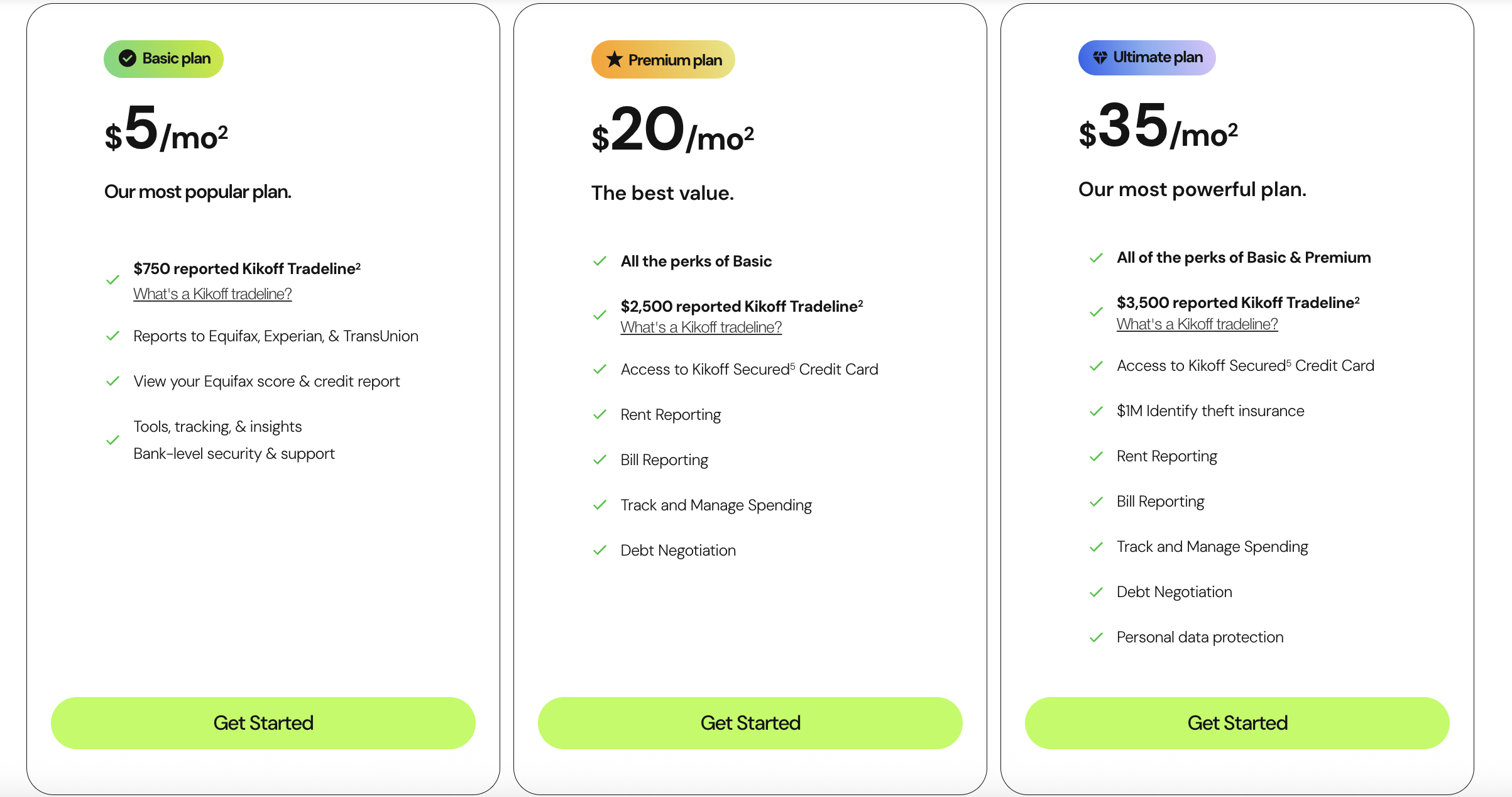

Kikoff’s three plan tiers, from the $5 Basic tradeline to the $35 Ultimate package with added perks.

$5 Tradeline: Lowest cost, reports to all 3 bureaus, best for thin files.

Kikoff Secured Credit Card: Coastal Community Bank issued, $50 minimum deposit, available only with $20+ Premium plan.

Rent Reporting: In Premium/Ultimate plans, sends data to Equifax, optional back-reporting for $50.

Credit Builder Loan: $10/month for 12 months, reports to Equifax/TransUnion, pays back $120 at term end.

Downsides

Tradeline can’t be used for everyday purchases.

Secured card requires a paid subscription.

Rent reporting only hits Equifax.

That felt like a half measure if I’m paying monthly, I want all three bureaus to see it, not just one.

Limited long term value once you qualify for better products.

Who Should Try Kikoff

Best for: First-time builders, rebuilders, renters paying on time.

Not ideal for: Those with multiple tradelines, need spending flexibility, or expect instant large score jumps.

Kikoff vs. Competitors

Here’s how Kikoff stacks up against other options:

Kikoff Basic: $5/month, no deposit, reports to all 3 bureaus. Catch: usable only in Kikoff store.

Kikoff Secured Card: Requires $20+ plan plus $50 deposit. Reports to all 3 bureaus, but subscription makes it pricier than it looks.

Self: Starts at $25/month, reports to all 3 bureaus. Stronger average gains but higher cost.

Chime Credit Builder: $0 fee, no fixed deposit, reports to all 3 bureaus. Requires opening a Chime account first.

Discover it Secured: No annual fee, $200+ deposit required, reports to all 3 bureaus. Solid path to a traditional card but needs upfront cash.

If you’ve read our Rocket Money breakdown, you know automation helps with budgeting. Pairing Rocket Money with Kikoff can ensure payments are always on time , protecting your gains.

Stacking for Faster Results

Kikoff works best as part of a credit-building toolkit:

Add a secured credit card (like Discover it Secured) for utilization and history.

Use a rent reporting service that reports to all 3 bureaus.

Try a builder loan from Self to diversify account mix.

Together, these tools target multiple credit score factors at once. If you’re also trimming expenses, check our KOHO review another app that helps Canadians stay financially disciplined.

FAQ

Does Kikoff hurt your credit? No, there’s no hard pull, but missed payments will hurt your score.

How fast does Kikoff build credit? First reporting is usually within 30–45 days, but meaningful gains take months of consistent payments.

Is Kikoff worth it compared to Self or Chime? If you want the lowest monthly cost, yes. But if you can afford higher payments, Self or a secured card might move your score faster.

Final Verdict

Kikoff isn’t a magic fix, but for $5/month it’s a low cost way to start building history. Know the true cost of the secured card, set realistic expectations, and it can be a smart first move.

What surprised me most is how split the reviews are for some it’s a quiet boost, for others it barely moves the needle. That kind of inconsistency is worth keeping in mind before signing up.

If you’re ready to start, Kikoff’s $5 plan is one of the lowest cost ways to begin building credit history here’s where to get started. Check out Kikoff

Cradle Score: 4.2 / 5