Rocket Money Review 2025: 7 Things I Learned After a Month of Use

This is my Rocket Money review after 30 days of cancelling subscriptions, tracking spending, and testing its features.

Ever opened your bank app and spotted a weird $12 charge for something you swore you canceled months ago? That was me. Cue Rocket Money.

This app claims it can cancel sneaky subscriptions, track bills, build a budget, monitor your credit score, and even negotiate with service providers. All in one dashboard. It sounds like a dream for people who hate budgeting but still want to feel in control.

But here's what most reviews skip. Rocket Money works very differently depending on where you live.

So I tested it as a Canadian, compared it to the American version, and broke down what actually works versus what’s just UI filler.

What Is Rocket Money, Really?

Rocket Money, formerly Truebill, was acquired by Rocket Companies. It's now a personal finance app that promises to manage your money without much effort. It’s pitched as a tool for everyday users, not finance nerds.

It offers:

Subscription detection and cancellation

Bill negotiation (U.S. only)

Spending tracking and budgeting

Credit score monitoring (U.S. only)

Net worth and cash flow dashboards

Smart savings goals (only functional in the U.S.)

On paper, it’s trying to be part Copilot, part YNAB, and part financial concierge.

U.S. vs. Canada: Same App, Different Reality

What Rocket Money can and can’t do — depending on where you live.

What works in both the U.S. and Canada:

Subscription tracking

Budgeting tools

Bank account linking for major institutions

Net worth dashboard

U.S.-only features:

Concierge subscription cancellation

Bill negotiation

Credit score monitoring

Smart savings automation

Canada-only limitations:

No concierge cancelation

No bill negotiation

No credit monitoring

Savings goals are visual only, not functional

From the outside, the app looks identical. But once you start using it, the differences show up fast.

Feature Breakdown (Hands-On)

1. Subscription Tracking

Rocket Money’s subscription tracker gives a clear view of what you’re paying for.

This is Rocket Money’s strongest feature across the board. It connects through Plaid, scans your bank and credit accounts, and flags recurring charges. It accurately picked up Spotify, Crave, Duolingo, and Adobe in my test. It even flagged a one-time insurance payment as potentially recurring, which was a fair guess.

Success rate: around 90 percent. You can manually tag or ignore any entries.

2. Canceling Subscriptions

In the U.S., Premium users can access a concierge team that handles cancellations. Sometimes that works through direct integrations. More often, someone on their team sends emails or calls on your behalf.

In Canada, you don’t get that. The “Cancel” button either redirects you to support pages or gives you company contact info. Helpful, but very DIY.

3. Bill Negotiation (U.S. only)

This feature is completely non-functional in Canada. In the U.S., users can upload bills from providers like Comcast, Spectrum, or Verizon. Rocket Money then attempts to negotiate for a lower rate and takes a percentage of whatever it saves.

This service doesn’t exist in Canada. The button shows up but leads nowhere.

4. Budgeting Tools

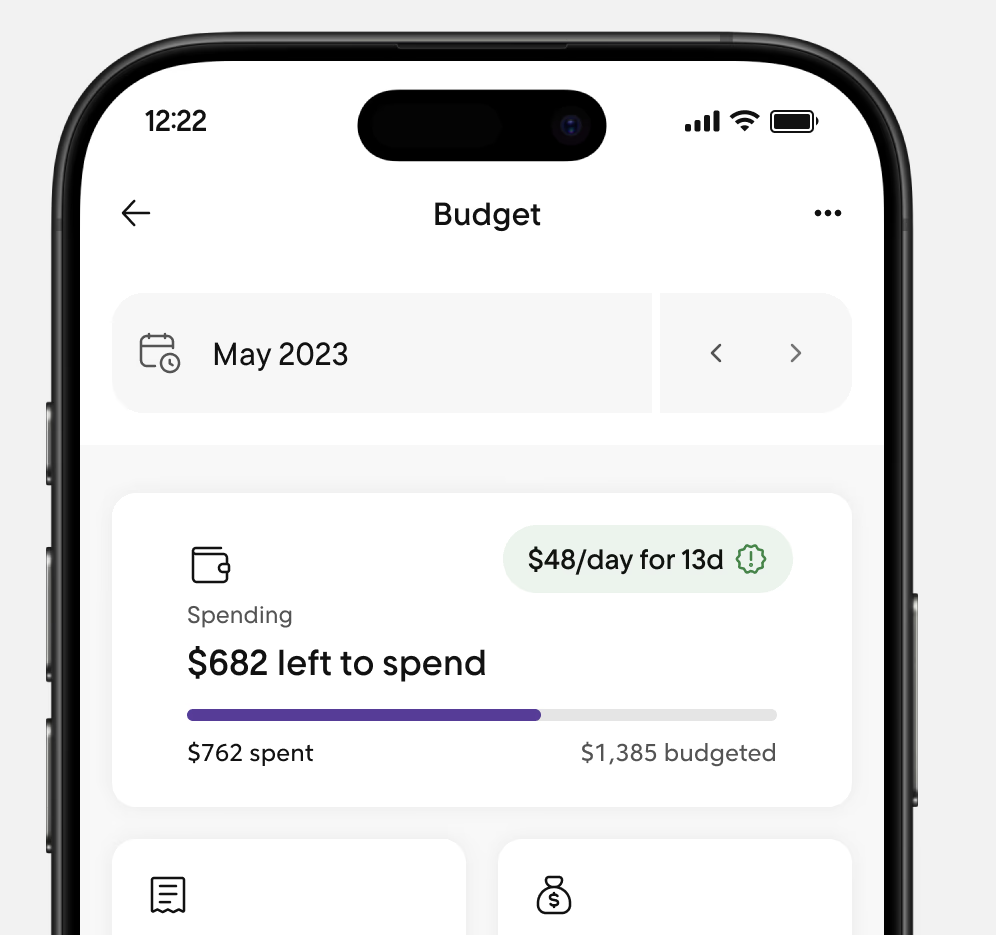

Rocket Money’s budget dashboard — clean, simple, and easy to follow.

This part works in both countries. It lets you assign spending limits to categories like Groceries, Dining, or Shopping. You’ll get basic alerts when you go over budget, and a monthly summary shows how you did.

It’s simple and clean. But you can’t do rollover logic or rule-based budgeting like in YNAB. There’s also no forward-looking projection or category automation like you’d see in Copilot.

Good for casual users. Too limited for power users.

5. Credit Score Monitoring

This works in the U.S. through Experian. It shows your score, credit utilization, and any recent changes.

In Canada, it’s just a ghost feature. The section appears in the app, but tapping on it leads nowhere unless you have a U.S. account.

6. Net Worth Dashboard

Rocket Money gives you a snapshot of your finances. Once accounts are linked, you’ll see:

Cash and checking balances

Credit card debt

Loan obligations

Investments (estimated)

It’s not highly detailed, but the visual layout is helpful. For most users, this dashboard is one of the more usable parts of the app.

7. Smart Savings Goals

In the U.S., Rocket Money can open a high-yield savings account and automate deposits toward your goals.

In Canada, this feature is completely blocked. You can set a goal visually, but there’s no way to automate anything. You’ll be doing everything manually.

Privacy and Trust

Rocket Money connects to your financial data using Plaid. It’s a well-known platform used by other apps like Wealthsimple and KOHO. It gives read-only access to your transactions and balances.

That said, Rocket Money still sees everything. You’re giving a Rocket Companies product full visibility into your financial life. If that’s a step too far, it’s worth pausing before linking accounts.

There’s no offline mode or manual option for entry.

Free vs. Premium

Free Plan (U.S. and Canada):

Subscription detection

Budget tracking

Net worth and spending dashboard

Charge alerts

Premium ($4 to $12 per month, user-chosen):

Cancelation concierge (U.S. only)

Bill negotiation (U.S. only)

Automated savings (U.S. only)

Priority customer support

If you’re in the U.S., Premium might pay for itself, especially if you have lots of subscriptions or bloated bills.

If you’re in Canada, the free version gives you most of what’s usable. Premium doesn’t unlock much extra.

What About International Users?

Rocket Money does not support most banks outside the U.S. and Canada. Since it relies on Plaid for linking, users in Europe, the UK, Asia, or elsewhere won’t be able to use the app meaningfully.

Even if you download it, you won’t be able to connect anything. You’ll get a clean dashboard with no data in it.

Who Should Use Rocket Money?

Good fit:

U.S. users who want simple, automated money tracking

Canadians who want subscription tracking and basic budgeting

People who forget recurring charges

Probably not worth it:

International users with unsupported banks

Privacy-focused users who avoid read-only integrations

Serious budgeters who need rules, rollovers, or projections

Cradle Score

For U.S. users, Rocket Money earns a 4 out of 5. Subscription management and bill negotiation give it real value.

For Canadians, the score drops to 3 out of 5. It works, but major features are missing.

Rocket Money could be a great all-in-one finance tool. But right now, it’s two different apps. Americans get the full experience. Canadians get a stripped-down version. Everyone else gets nothing.

If you’re curious, try the free version. Just don’t expect it to be the fix-all it markets itself to be.