Copilot Budget App Review 2025: Why I Switched (and What Shocked Me)

This is my honest Copilot Budget App review after using it for a full month, tracking every expense and goal.

Let’s get one thing straight: budgeting apps suck. They’re either clunky, ugly, or so obsessed with spreadsheets that they forget you're a human being with a life. But Copilot is trying to change that and honestly? It’s probably the closest thing to what Mint should’ve evolved into before it got shut down and thrown into the Google graveyard.

So I took Copilot for a spin. Here’s everything you need to know the good, the annoying, and whether it’s actually worth paying for.

What is Copilot?

Copilot is a premium budgeting app for iOS and Mac that connects to your bank accounts, credit cards, and investments to give you a clean, customizable overview of your finances. Think of it as a personal finance assistant minus the judgment and weird graphs you never asked for.

It pulls in your transactions automatically (via Plaid), categorizes them using a mix of AI and your own rules, and shows you:

Where your money's actually going

What bills or subscriptions are coming up

Whether you're on track for the month

It's not trying to be a bank. It's trying to be your money command center.

First Impressions: This Is… Smooth?

Copilot’s dashboard gives a clean, real-time overview of your budget without the clutter — no ads, no noise, just your money at a glance.

Right away, the interface feels different. It’s designed, not just functional. No ads. No upsells. No “connect to our credit score partner” garbage. Just a smooth, focused dashboard.

The AI-assisted transaction tagging is scary good. Out of 150 transactions, it got about 90% right without any help. The rest? Easy to fix and Copilot learns fast.

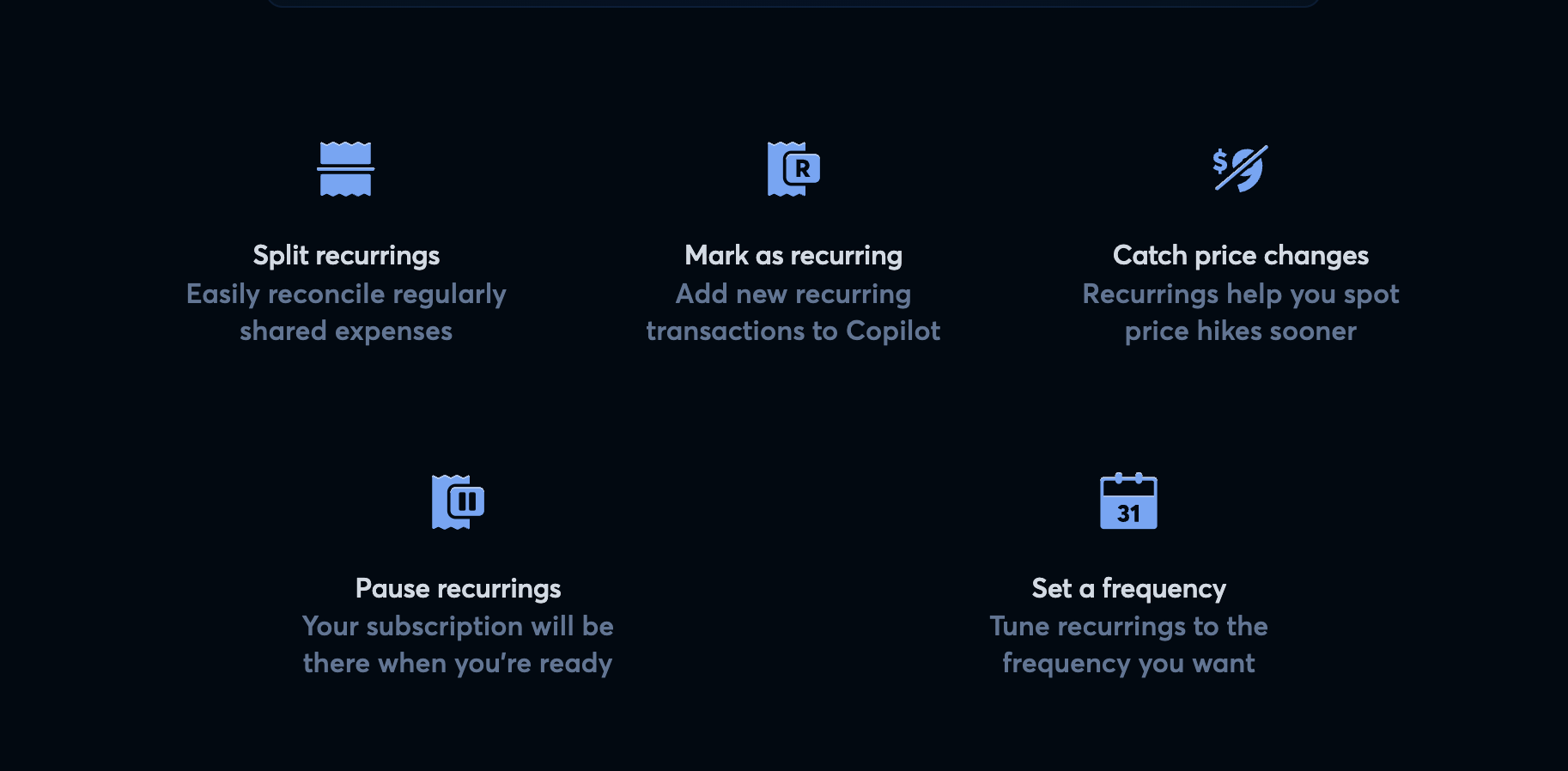

The real win, though, is custom categories and recurring expense tracking — something most free tools completely botch.

Features That Actually Matter

Here’s what stood out during my testing:

Real-Time Syncing (mostly)

Transactions show up within a few hours. It’s not “instant,” but it’s fast enough to feel current.

Smart Budgeting Without Guilt

Set monthly budgets by category, track against them in a way that’s visual, not spreadsheety. It doesn’t make you feel like you’ve failed because you spent $6 over on groceries.

Subscription Tracking That Works

Copilot automatically flags upcoming subscriptions and bills — even the sneaky ones you forgot you signed up for.

Finally. It automatically detects recurring charges and shows you upcoming ones in a calendar view. Yes, even the sneaky ones like that random Apple TV trial you forgot to cancel.

Net Worth Tracking (with Investments!)

It pulls in balances from your savings, debt, and investment accounts. Bonus points for supporting crypto portfolios too (Coinbase, Gemini, etc.).

Widgets + iOS-First Perks

Beautiful iOS widgets for at-a-glance views. And the Mac app is native and fast — not some clunky web wrapper.

The Drawbacks (Because Nothing’s Perfect)

$95/year or $13/month It’s not cheap. But there’s a free trial.

Apple ecosystem only No Android or Windows support. That’s a dealbreaker for some.

No shared budgeting or partner mode Not great for couples or roommates who want joint planning.

Occasional sync issues Rare, but I had 2–3 transactions pull in late during the week.

Real Use Case: After 7 Days of Testing

I imported 6 accounts, set up custom categories (like “soccer gear” and “stupid impulse buys”), and tried to live with it daily.

It made me:

Cancel a subscription I forgot I had

Realize I spend too much on Uber Eats

Catch a weird duplicate charge on my Amex

I’ve used Mint, YNAB, Monarch, and spreadsheets. This felt like the first app that balanced aesthetics + usefulness without making me feel like a financial failure.

Would I use it long-term? If I was deep in the Apple ecosystem and wanted an elegant, no-BS finance hub absolutely.

Who It’s For (and Who It’s Not)

Use Copilot if you:

Want a premium, private, zero ad budgeting experience

Prefer iPhone/iOS tools that feel native

Like visuals more than Excel hell

Don’t mind paying for design and usability

Skip it if you:

Use Android or Windows — there’s literally no support

Need couples/joint budgeting

Are looking for a totally free tool

Cradle Score: 4.2 / 5 🧮

Copilot isn’t revolutionary. But it’s refined. It fixes what made Mint annoying, without becoming a spreadsheet app for finance nerds. If you're serious about personal finance and want something smooth, private, and actually nice to use it's one of the best options out there.

Cradle Score Breakdown:

Ease of Use: ⭐⭐⭐⭐½

Features: ⭐⭐⭐⭐½

Price-to-Value: ⭐⭐⭐⭐

Customization: ⭐⭐⭐⭐

Platform Support: ⭐⭐ (Apple-only hurts)

Looking for an alternative with shared budgeting? Check out our review of Monarch Money