YNAB vs Monarch Money in 2025: The Winner After 60 Days of Testing

I tested YNAB and Monarch Money side by side for 60 days to see which budget app actually works better.

Forget the Excel sheets, the clunky bank apps, and the stress of trying to remember where your money went last week. For the longest time, I managed my finances like that — jotting stuff down, occasionally checking my balance, and mostly guessing if I was "okay."

But eventually, the stress crept in. Subscriptions kept renewing, unexpected expenses hit, and I had no real system. That’s when I decided to try real budgeting apps — and after testing a few, YNAB and Monarch Money stood out as the most life-improving.

They didn't just help me budget better. They helped me feel more in control, save more each month, and even start planning things like vacations, subscriptions, and emergency funds without guilt.

Here’s how both tools work, how they differ, and how each one improved my day-to-day life in its own way.

🧠 What Is YNAB?

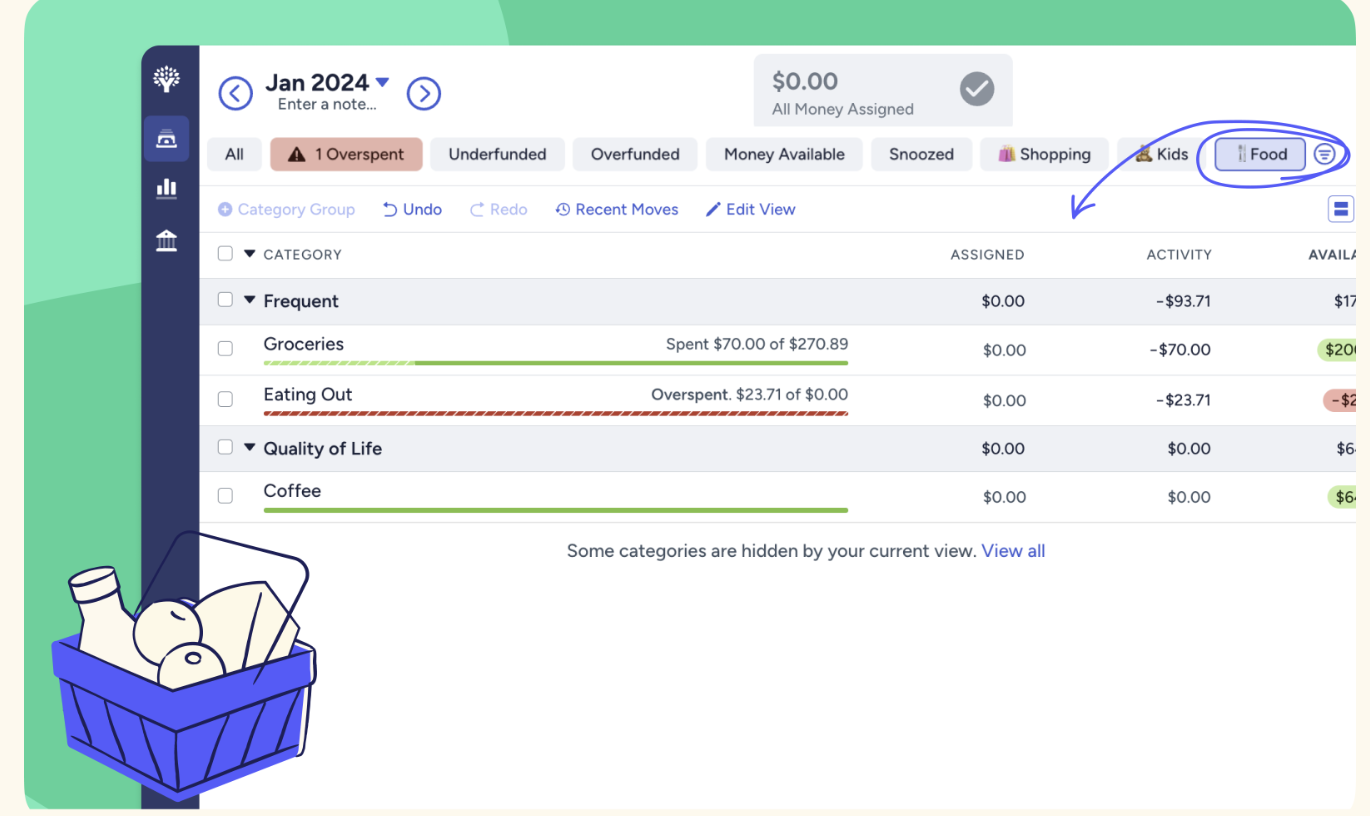

Image: YNAB budgeting dashboard with spending categories

YNAB (You Need A Budget) is a hands-on budgeting system that forces you to tell your money where to go before you spend it. It follows four rules:

Give every dollar a job

Embrace your true expenses

Roll with the punches

Age your money

You don’t just track money — you plan it. You only budget money you actually have (not future income), and you have to manually move money around if life happens. At first, it feels strict. But within a week, it starts making sense.

✅ Pros of YNAB:

Hyper-intentional: Every dollar has a role

Extremely detailed: You control everything, down to the penny

Encourages long-term thinking (e.g., saving for car repairs, gifts, subscriptions months in advance)

Great for people who like full control

Supports irregular income planning and cash-based budgeting with ease

YNAB’s category system helps you build “sinking funds” — like $20/month toward a future car repair or yearly membership. It’s a mindset shift that turns unpredictable expenses into predictable ones. It also works surprisingly well for people with freelance or variable income, since you only budget money you already have.

❌ Cons:

No automatic syncing with some banks (depends on region)

Learning curve — it’s not plug-and-play

Manual effort can feel like a chore at first

🧍♂️ Day-to-Day User Insight:

Using YNAB feels like using a planner. It gave me a habit. I started checking in every few days, and just that small ritual helped me be more intentional. I stopped impulse spending as much. I noticed I was actually building up small savings goals — like putting away $100/month for travel. That would've never happened before. It helped me say "yes" to fun stuff without worrying I’d regret it later.

💻 What Is Monarch Money?

Image: Monarch Money app interface showing financial overview

Monarch is a modern, visual money management tool. Instead of focusing on budgeting every dollar, it helps you understand your full financial picture. It syncs your accounts, tracks your cash flow, shows your net worth, and lets you set visual goals.

It feels less like a budget, more like a dashboard for your life.

✅ Pros of Monarch:

Beautiful, clean interface

Automatically syncs with most major banks, credit cards, investments

Great for couples or families (shared access)

Easy to set goals: vacations, debt payoff, emergency funds

Subscription tracking shows recurring expenses clearly

One of Monarch's best features is its visual goal tracker. You can create savings goals — say $500 for a weekend trip — and Monarch shows your progress with automatic calculations based on your linked accounts. If you share finances, both users can see and contribute to these goals. It also highlights recurring expenses like streaming services or memberships, which makes cutting unnecessary costs way easier.

❌ Cons:

Less detailed control compared to YNAB

Might feel too hands-off for detail lovers

Paid subscription only (no free tier)

🧍♀️ Day-to-Day User Insight:

Monarch is perfect if you don’t want to touch your budget daily. I liked opening it once a week just to see where things stood. Seeing all my accounts in one place made me feel calm instead of overwhelmed. It showed me trends I wasn’t even aware of — like how my spending spikes in the middle of every month. I used it to track saving for a weekend trip, and it actually made me want to save more because I could see the progress visually.

💰 What About Pricing?

Both tools are paid — and honestly, that’s part of why they work. You’re more likely to use something you’re investing in.

YNAB Pricing (as of 2024):

$14.99/month or $99/year

Free 34-day trial

Offers a 12-month free plan for students with valid ID

YNAB is best for people who will check in regularly — if you use it passively, it won’t feel worth the price.

Monarch Money Pricing (as of 2024):

$14.99/month or $99/year

7-day free trial

No free tier, but includes full account syncing + shared access

Monarch is more visual and automatic — great if you want less effort day-to-day.

⚖️ YNAB vs Monarch – Which Is Better?

Use YNAB if:

You want to be super intentional with spending

You don’t mind updating things manually

You’re trying to get out of debt or stop living paycheck to paycheck

CRADLE SCORE: 3.75/5

Use Monarch if:

You want a clean overview of your entire financial life

You share finances or budget with a partner

You prefer set-it-and-check-it budgeting vs daily input

CRADLE SCORE: 4/5

🧾 Final Thoughts

Both of these tools are designed to help you stress less about money, but they do it in different ways. I don’t think one is objectively better — it’s about how hands-on you want to be.

If you’re tired of second-guessing your spending, or feel like you’re always “managing” your money but never really seeing it, try one of these. I wish I had years ago.

Let me know if you’ve used either — or something else entirely. I’m still learning, and always down to try smarter ways to stay on track.