Forget Excel: These Budgeting Apps Actually Make Sense

I’ve tried being the spreadsheet person. Really, I have. But if you’ve ever stared at a blank Excel sheet thinking, “I'd rather just pay the overdraft fee,” you’re definitely not alone.

Most budgeting tools seem like they're made for finance majors—charts, formulas, and categories you can't even pronounce. Whatever happened to simply knowing where your money went?

So, I set out to find budgeting apps that felt genuinely human—tools that actually work without piling on anxiety or assuming you were born financially literate. These are the few that made sense, stuck with me, and didn’t make me feel like a failure at adulthood.

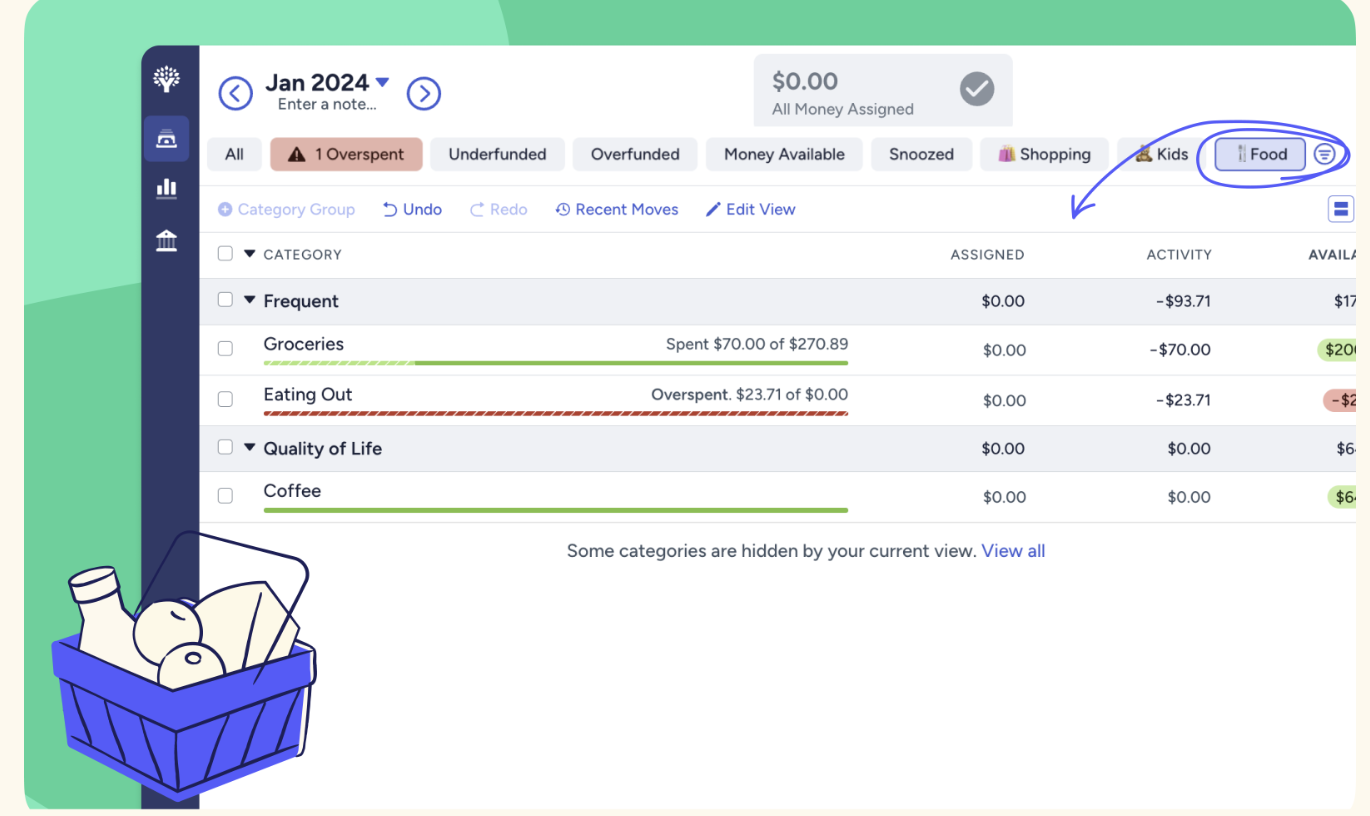

YNAB — For the methodical planner who actually wants to learn

YNAB lets you assign every dollar a purpose — if you’re into structure, it’s gold.

YNAB (You Need a Budget) isn’t just an app—it’s a whole system. And honestly, it works.

The core idea? Every dollar gets a job. You don't guess next month's grocery or gas spending; you budget based on what you have right now. It flips traditional budgeting upside down, teaching you to spend based on reality, not predictions.

If you're someone who thrives on structure and doesn’t mind a slight learning curve, YNAB will reshape your relationship with money. The mobile app is intuitive, the desktop version is robust, and the tutorials are among the best out there.

But it's definitely not for the impatient. The first few days feel like learning a foreign language, and the $14.99/month cost might sting initially. Still, if you're serious about forming lasting financial habits, it's worth the effort.

Cradle Score: 4/5

👉 Read our full YNAB vs Monarch comparison

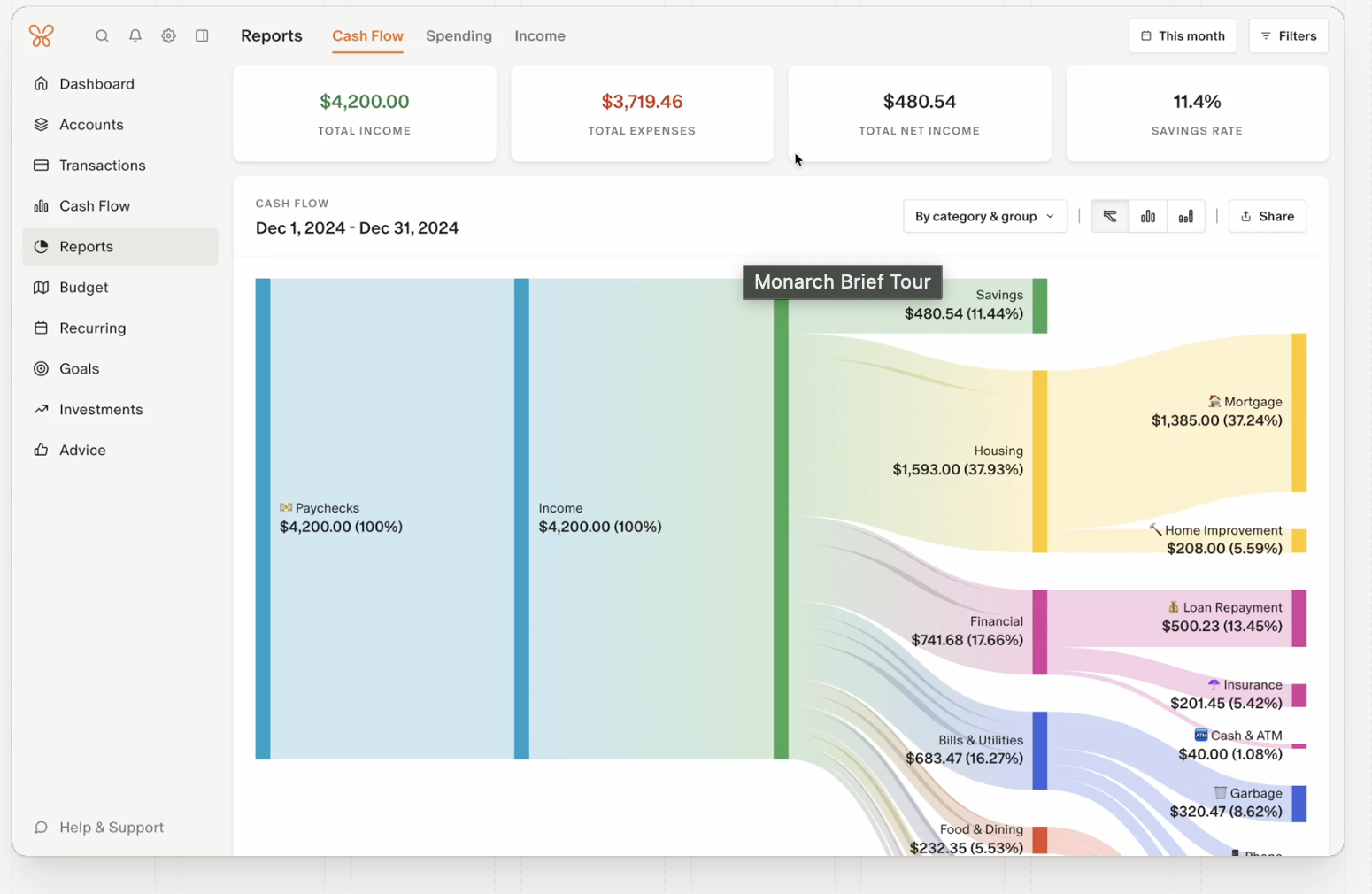

Monarch — Budgeting for goal-oriented visual thinkers

Monarch gives your money goals a minimalist home without the chaos.

Monarch is the answer to the question, “What if budgeting wasn't ugly?”

Everything about Monarch feels clean and intentional. It’s great for visual learners and ideal for people budgeting with a partner or family. You can easily set savings goals, track spending trends, and customize categories without feeling overwhelmed. Shared accounts make it especially useful for couples seeking clarity without conflict.

What really stood out to me was the lack of judgment. Monarch doesn't lecture—it simply shows what's happening and gently asks what you'd like to do next. The weekly digest feels genuinely helpful, more like a friendly check-in than a guilt trip.

It won’t explicitly teach you a system like YNAB, but it gives you plenty of space to comfortably find your own rhythm.

Cradle Score: 4.2/5

👉 More on how Monarch stacks up

KOHO — Daily budgeting meets modern spending

KOHO blends spending and saving into one slick, daily-use tool.

KOHO isn’t your traditional budgeting app—it’s a prepaid card, cashback tool, and savings assistant all in one.

Perfect for people who don't want budgeting to feel like budgeting. Each time you use KOHO, it automatically updates your balance, categorizes your spending, and gently nudges you toward smarter choices. You can set savings goals, round up purchases to stash away spare change, and even access your paycheck early if your employer allows it.

The virtual card feature makes online spending safer, and the optional premium plan offers deeper insights. KOHO feels particularly suited for younger users—students, new graduates, or anyone looking to steer clear of credit card pitfalls.

Cradle Score: 4.3/5

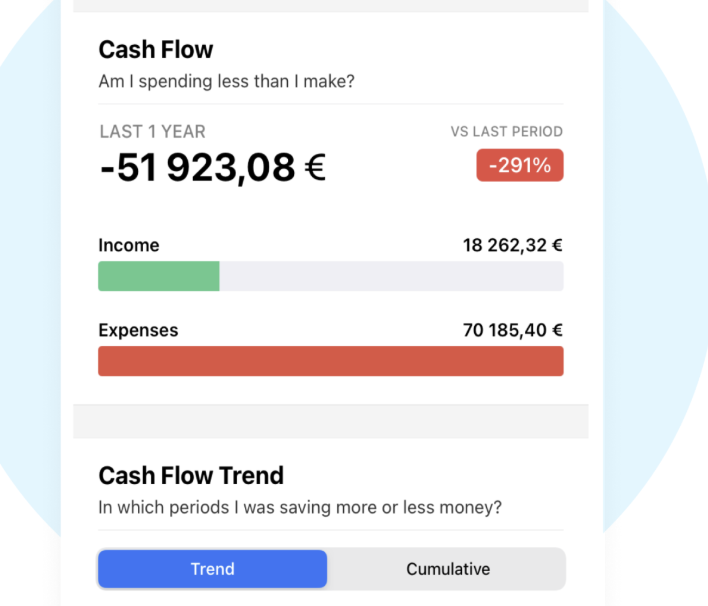

Wallet by BudgetBakers — Quiet, capable, Android-friendly

Wallet may fly under the radar, but it gets the job done.

Wallet might not be flashy, but it's quietly effective.

It connects seamlessly to your bank accounts, tracks spending across various categories, and provides clear, simple insights. If you're an Android user or need something supporting multiple currencies and accounts, this could be your new favorite.

What stood out to me was the balanced experience—not overly complex, yet far from basic. Features like receipt scanning, recurring payment tracking, and handy budget templates never felt like a chore. Plus, you can easily share your budgets with family or a partner.

It might lack the polish of Monarch or the habit-forming structure of YNAB, but it quietly gets the job done. Particularly useful if you're freelancing or managing multiple side gigs.

Cradle Score: 3.9/5

Mint — Gone, and honestly, that's fine

Mint was the OG budgeting app. If you've ever budgeted, you probably tried Mint—but Intuit shut it down in 2024.

Was it good? Back in its prime, sure. But these newer apps are simply better designed, more flexible, and less cluttered. Mint became slow, clunky, and bloated with ads—like a band that overstayed its welcome.

Time to move on.

What Actually Helped Me Budget

What finally clicked for me wasn't a perfect pie chart or a fancy dashboard—it was just being able to clearly see my finances without decoding complicated numbers.

Monarch offered a calming layout. KOHO was reliable for daily spending. YNAB provided solid structure, and Wallet kept a quiet eye on everything else. Each app addressed a specific need.

The best budgeting app? It’s honestly the one you'll actually open. Don’t let subscription costs or feature overload scare you—try a few, find one that sticks, and remember: it's progress, not magic.

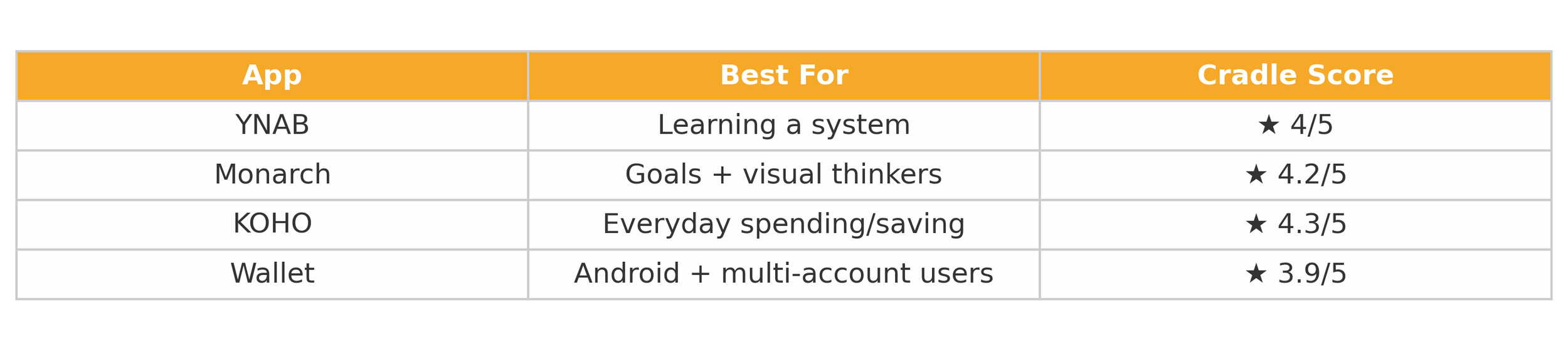

Cradle Roundup

Here’s how each app stacked up, based on real-world use.

Note: Not sponsored. Just tools I tested that didn’t suck.

Stay in control (or at least pretend to). Stay curious.