TFSA vs FHSA in 2025: Which Account Actually Helps You Save Smarter in Canada

No Acronyms, No BS

If you’ve ever Googled TFSA vs FHSA, you’ve probably ended up knee deep in jargon, pie charts, or government PDFs. Nobody has time for that. The truth is simple: these accounts can either help you buy your first home or quietly make you wealthier over time if you start today.

At ToolCradle, our goal isn’t to flex financial jargon. It’s to cut the noise and give you practical ways to move closer to financial freedom. Whether you’re 22, 35, or 50, TFSA and FHSA are tools you can actually use. Here’s the straight answer.

TFSA and FHSA in Plain English

A TFSA, or Tax Free Savings Account, is open to Canadians once they turn 18. In 2025, you can contribute up to $7,500. If you’ve never contributed before, your total lifetime room is about $102,000 by now. The magic of the TFSA is that any growth inside it, whether investments, dividends, or interest, stays tax free. You can pull the money out whenever you want, and the amount you withdraw gets added back to your contribution room the following year.

The FHSA, or First Home Savings Account, is a newer tool designed specifically for first time buyers. You can open one if you’re between 18 and 71, but only if you haven’t owned a home in the past four years. You can put in $8,000 a year, up to a lifetime maximum of $40,000. Contributions are tax deductible, like an RRSP, and growth is tax free. The catch is that you need to use it for a first home within 15 years, otherwise it gets rolled into an RRSP or RRIF.

Key differences in plain words:

TFSA: $7,500 a year in 2025, around $102,000 total room if you’ve never used it. Growth and withdrawals are tax free, and you can use the money for anything.

FHSA: $8,000 a year up to $40,000 lifetime, tax deductible contributions, but restricted to a first home purchase. If unused, it rolls into your RRSP.

Cutting Through the BS

Here’s what the glossy bank brochures don’t say. FHSA gets hyped as “free money” because of the tax deduction. That’s great if you’re absolutely sure you’ll buy, but if life changes you lose flexibility. On the flip side, TFSA often gets pitched as a boring “savings account with perks.” That’s wrong. It’s the most flexible wealth building account Canadians have. You can grow investments here for decades and never pay tax on the gains.

Bottom line: FHSA is specialized. TFSA is universal.

What Happens If You Start Today (By Age Group)

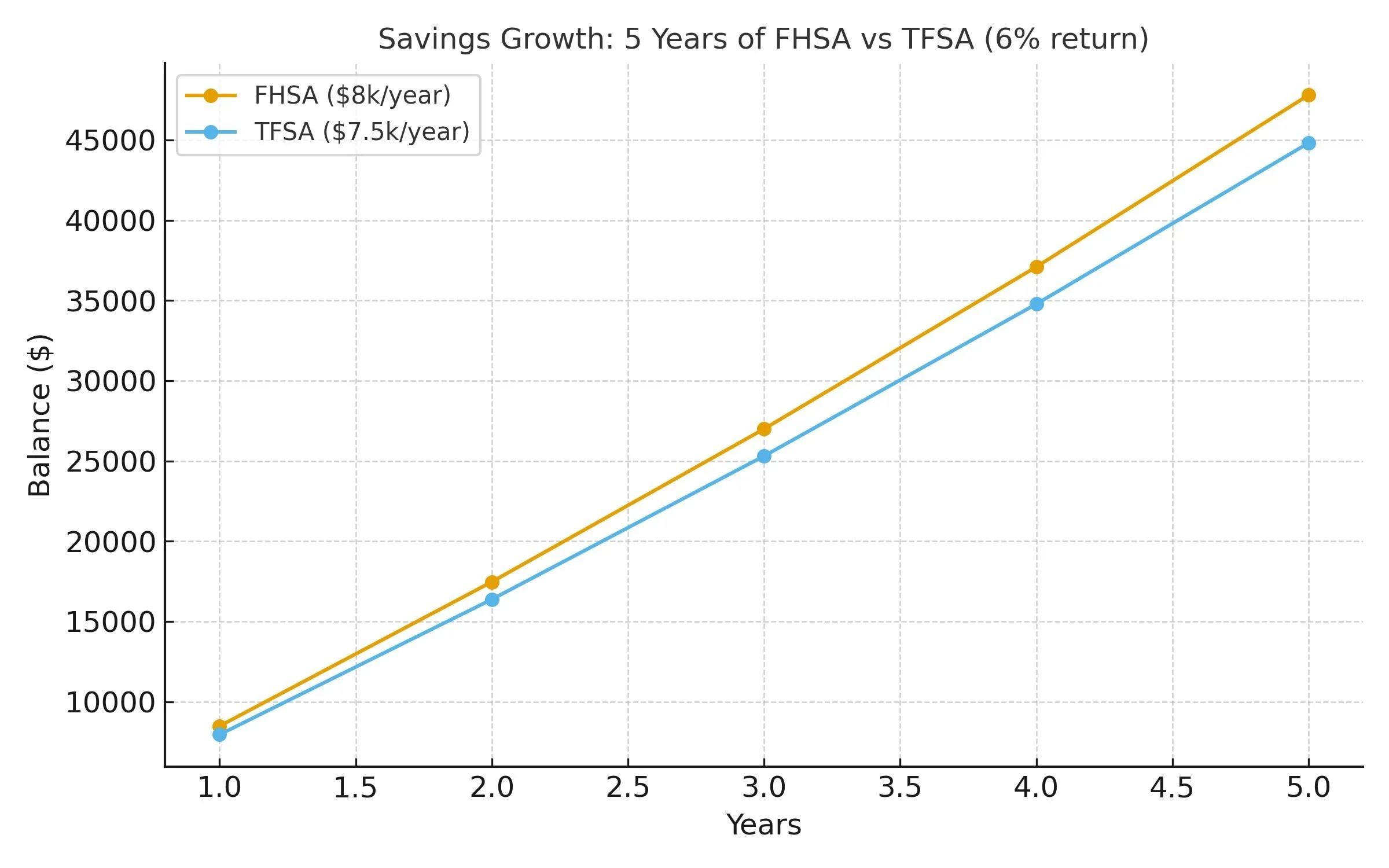

Five years of consistent contributions. FHSA edges ahead slightly, but both accounts build serious momentum.

In Your 20s – First Time Buyer Mode

Say you contribute $8,000 a year into an FHSA. After five years, you’ve maxed out the $40,000 limit. Invest that in an ETF like XEQT and, at about six percent growth, you’d have around $46,000. Add a $20,000 TFSA cushion on the side, and suddenly you’re sitting on $66,000. That’s a serious down payment in many Canadian cities and a good head start even in Toronto or Vancouver.

Here’s how someone in their 20s might play it out: set up an FHSA in Wealthsimple, automate $650 contributions each month, and invest it in a simple all in one ETF. After five years, the account is full, the investments have grown, and you’ve also got a TFSA working in the background. By the time you’re ready to buy, you have a down payment saved without micromanaging.

In Your 30s–40s – Flexibility First

Maybe you’re not sure if buying a home is even in the cards. This is where TFSA shines. Put in $7,500 a year, invest it, and after five years you’re looking at about $43,000. There are no penalties and no deadlines. If you need the money for an emergency or a career shift, it’s there. If you later decide to buy, you can still open an FHSA and layer it on top.

An example: you’re 35, renting downtown, and not sure if you’ll stay in the city. You build a TFSA portfolio of index funds worth $30,000 after a few years. Suddenly, you’re laid off. That TFSA gives you breathing room while you find the next gig. No penalties, no tax, no hoops to jump through. If life steadies and you want to buy, you can still start an FHSA at that point.

In Your 50s+ – Beyond the First Home

At this point, the accounts play a different role. TFSA still protects your investments tax free, whether that’s retirement savings or a rainy day cushion. Contribute $7,500 a year and let it compound, those gains are untouchable by CRA. FHSA, if unused, rolls into an RRSP, so you don’t lose the tax advantage. It’s less about a first home now and more about protecting wealth.

Think about someone who’s 55 and focused on retirement. They might max out TFSA each year with dividend ETFs, earning tax free income to supplement retirement later. The FHSA they opened years ago but never used quietly slides into their RRSP, boosting retirement savings without extra work. They haven’t lost anything.

The Smarter Play — Use Both

If you know a home is in your future, start maxing the FHSA now and enjoy the tax refund. If flexibility matters more, keep filling your TFSA because it’s your forever account. The real win comes from using both. FHSA gives you an immediate tax break and accelerates your home purchase, while TFSA builds long term freedom no matter what path you take.

For example, a couple could each max their FHSA over five years, stacking $80,000 plus growth. Combine that with two fully funded TFSAs and suddenly they have a six figure pool of money. That’s the difference between scraping for a down payment and walking into a mortgage negotiation with options.

Tools That Make It Easy

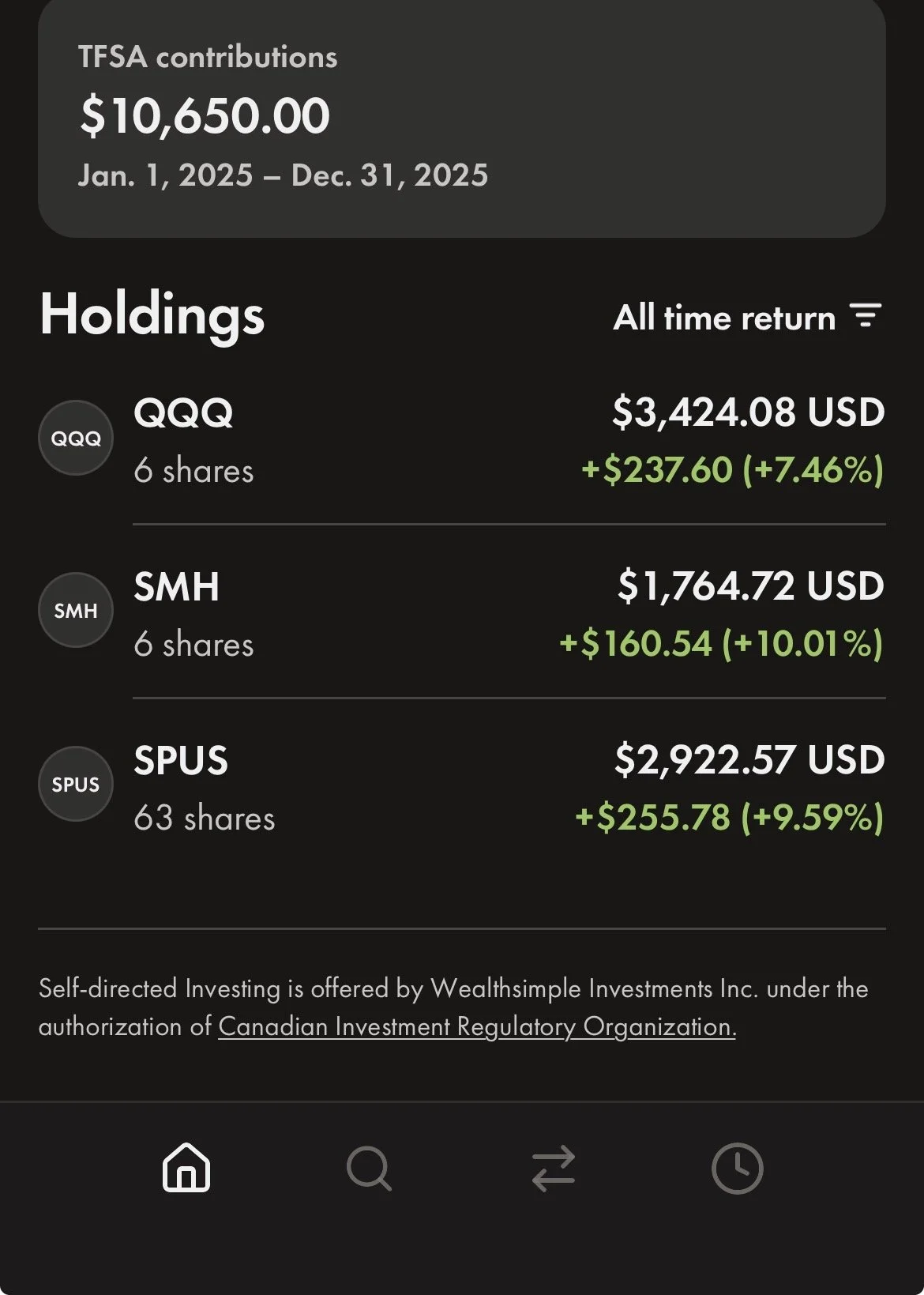

Wealthsimple TFSA portfolio screenshot showing holdings in QQQ, SMH, and SPUS ETFs with positive returns.

Opening these accounts at a big bank usually means paperwork, forms, and sitting on hold. That’s where Wealthsimple changes the game. You can open both FHSA and TFSA in about 10 minutes. Contributions can be automated so you don’t have to think about it. You can invest in ETFs like XEQT, QQQ, or dividend funds with one tap. And the dashboard is clean, without acronyms buried in small print. If you want the full breakdown of how Wealthsimple works for Canadians, check out our Wealthsimple review where we covered the setup in detail.

Picture this: you download the Wealthsimple app (referral link), tap to open FHSA and TFSA, and set up an automatic $500 a month split between them. In a year, you’ve contributed $6,000, earned tax free growth, and didn’t lift a finger. That’s what makes the tool useful, it takes the friction out of saving.

We tested Wealthsimple’s FHSA and TFSA setup. Compared to banks, it’s refreshingly painless. For someone starting from zero, it takes the intimidation out of investing.

ToolCradle Take

Cradle Score: 4.3 / 5 for Wealthsimple’s FHSA and TFSA combo.

It’s beginner friendly, quick to set up, and transparent. The only drawback is limited advanced features for pros, but if you’re starting your first savings journey you don’t need complexity, you need clarity.

The outcome if you start today is simple: more contribution room every year, faster compounding, and a cushion that moves you toward financial freedom, whether that means a house, retirement, or simply peace of mind.

Closing

At ToolCradle, we’re not here to push acronyms. We’re here to give you tools you can actually use. TFSA and FHSA aren’t glamorous, but they’re the foundation. Start today, and you’re not just saving, you’re buying yourself options, security, and a faster track to freedom.