I Tried Gemini for Crypto, Here's the Honest Truth

I’ll be real: I didn’t expect much from Gemini.

After bouncing between janky mobile wallets and offshore exchanges that treated my region like a forbidden zone, I was skeptical. One app throttled my withdrawals for "security checks" that lasted two weeks. Another let me buy a coin that got delisted 24 hours later. So when someone recommended Gemini, I rolled my eyes. I didn’t need another crypto letdown.

But I gave it a shot anyway.

Turns out? It’s one of the most stable, quietly competent exchanges I’ve tested.

This blog breaks down everything I discovered: every feature, every fee, and every frustration. It’s not a hype piece. It’s a field report.

What even is Gemini?

Gemini is a New York-based cryptocurrency exchange founded in 2014 by the Winklevoss twins. Yes, the same ones from the early Facebook story. But they’ve shifted gears and turned Gemini into one of the most regulation-focused crypto platforms in the world.

Unlike most exchanges that brag about decentralization while hiding their headquarters, Gemini leans into compliance. It’s regulated by the New York State Department of Financial Services and holds SOC 2 Type II certification. That makes it one of the few exchanges built from the ground up to play nice with traditional finance.

Gemini is available in over 60 countries and supports both individual and institutional clients.

What's it like to actually use?

Sign-up and KYC process

The onboarding experience was fast and painless. I signed up with email and phone, submitted ID and address verification, and got approved in under an hour. No selfie loops. No weird holding patterns. No buried terms.

Once in, the layout was refreshingly minimal. After the last year of using exchanges that looked like casino floors, this felt like opening a banking app, in a good way.

Interface: basic in a good way

The main dashboard is extremely clean. You get a home screen showing your portfolio, quick buy/sell buttons, and a simple asset list. It doesn't blast you with candles or meme tokens.

There are two main modes:

Gemini UI (default): Geared toward beginners, with recurring buy options, asset descriptions, and zero visual clutter.

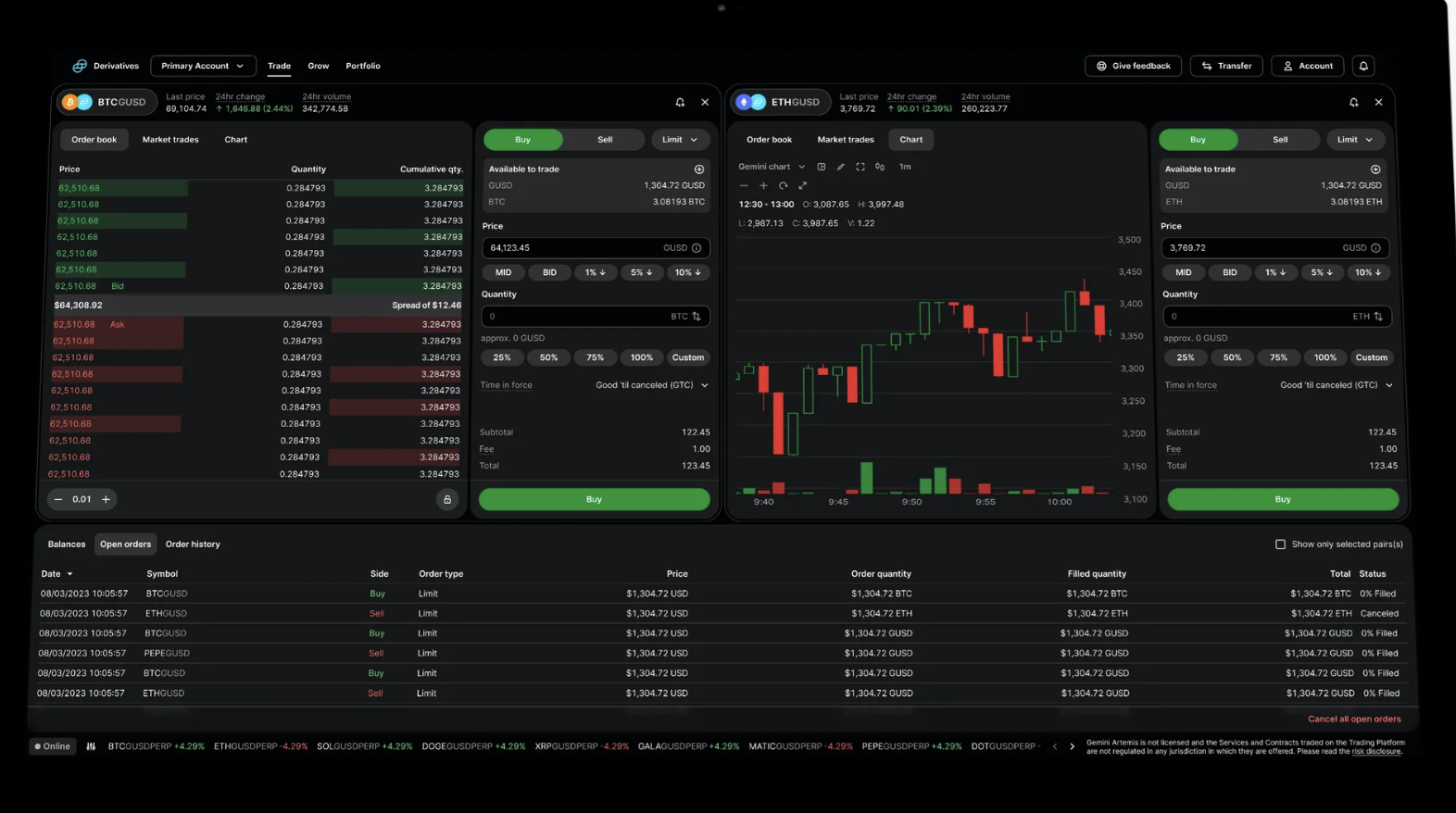

ActiveTrader: A separate interface with advanced charting, depth-of-market views, and tiered fee structures

ActiveTrader is like switching from automatic to manual transmission. Clunkier at first, but more efficient once you get used to it.

What crypto can you actually buy?

Gemini supports over 100 crypto assets, including:

Major coins: Bitcoin, Ethereum, Litecoin, Dogecoin

Stablecoins: GUSD, USDC, DAI, Tether

Altcoins: Solana, Cardano, Avalanche, Chainlink, Uniswap, Aave, Filecoin, Cosmos, and others

There’s no meme coin spam or freshly minted vaporware. Gemini curates its listings with a focus on regulatory compliance. That might feel limiting to some, but for long-term holders, it helps avoid a lot of junk.

If you're in Canada, yes, CAD deposits via Interac work natively.

A test buy: how smooth is it?

I did a real test. Bought $50 worth of ETH using Apple Pay. It took two taps. Gemini gave me a final price quote including fees, processed the payment instantly, and the ETH appeared in my account within seconds. No delays. No weird holds. No surprises.

I withdrew it to my external wallet right after, and the request was approved in under 10 minutes. It’s rare for a platform to nail both directions that cleanly.

👉 Want to try it yourself? Here’s the link I used. (Supports the blog.)

Payment methods and funding options

Here’s what you can use to fund your account:

Bank transfers (ACH in the U.S.)

Debit cards

Wire transfers

Apple Pay and Google Pay (in select regions)

Interac e-Transfer and wire in Canada

No PayPal. No Venmo. No crypto-only deposit restrictions.

You get 10 free crypto withdrawals per month, which resets monthly. After that, fees apply based on network activity. Fiat withdrawals via ACH are free in the U.S., but international users should check local bank fees.

How are the fees, really?

Standard Gemini UI fees:

1.49 percent fee on most trades over $200

Flat fees under $200 (e.g., $2.99 on a $200 trade)

Slight hidden spread baked into the price quote

ActiveTrader fees:

Gemini’s pro-tier trading (ActiveTrader) mode built for precision without the chaos.

0.25 percent maker / 0.35 percent taker (entry tier)

Discounts available for higher monthly trading volume

The standard interface is expensive. That’s the trap. Most casual users never switch to ActiveTrader, which is the only way to lower your fees.

No staking discounts. No fee tiers based on token holdings. It’s a flat system, for better or worse.

Security: Gemini’s core strength

Security isn’t a marketing blurb here. It’s the foundation.

Highlights:

SOC 2 Type II certified

Cold storage for most crypto

Device approval and login history tracking

Two-factor authentication (SMS or authenticator app)

Withdrawal address allowlisting

No hacks since launch in 2014

Some users report that withdrawals take slightly longer than on platforms like Binance or Coinbase. That’s true. But Gemini’s entire posture is about prioritizing safety over speed.

What else does Gemini offer?

Gemini Earn (Paused)

Previously allowed users to earn interest on idle assets. It was suspended due to the Genesis bankruptcy. As of mid-2024, over 97 percent of user assets have been returned in kind, with the remainder expected within 12 months. There is still no official timeline for relaunch, and SEC litigation remains unresolved.

Gemini Wallet

You get a custodial hot wallet by default. Insurance covers breaches on Gemini’s end, not user error. You can easily transfer to a self-custody wallet.

Gemini Credit Card (U.S. Only)

Available to U.S. residents, it earns crypto rewards in real time on purchases. You choose the reward crypto. Integrated cleanly into the app. Up to 3 percent back.

How does Gemini compare?

How Gemini stacks up against Coinbase, Kraken, Binance, and Crypto based on fees, features, and global support as of July 2025.

Gemini holds up best if you're looking for a platform that trades a bit of flash for stability and trust.

Where Gemini falls short

Fees are high by default unless you switch to ActiveTrader

Price spread isn’t transparent

Mobile app performance is inconsistent, especially on iOS

No DeFi tools (staking, swaps, liquidity pools)

Gemini Earn is paused with no ETA, though most funds have been returned

These aren’t catastrophic, but they matter depending on your use case.

Who should actually use Gemini?

Gemini is ideal for:

Beginners who want a clean and regulated experience

Users who care more about security than having 300 altcoins

People in regions where major exchanges have pulled out

Gemini is not ideal for:

DeFi-focused users

Altcoin traders looking for early listings

Users who refuse to pay above 0.25 percent in fees

Final Verdict

Gemini is what happens when you build a crypto exchange like a legacy bank, cautious, polished, and allergic to chaos.

It’s not the most exciting platform. But it’s dependable. If you’re done spinning the roulette wheel with offshore platforms and want something boring in the best way possible, Gemini is your safe zone.

If that sounds like your kind of vibe, try it here (supports the blog): Try Gemini

Cradle Score: 4.1 / 5

✅ Regulated and secure

✅ Beginner-friendly

✅ Available in multiple countries

❌ High default fees

❌ Lacks tools for power users

Simple. Trustworthy. Understated. And maybe that’s what crypto needs more of.